Game theory, asymmetric opportunities, and how I lost $40 million

I love incentives. I enjoy thinking about what motivates people, what motivates myself, and, in general, how people make decisions – large and small. A special case in the study of incentives is game theory.

Many things that are not (literally) games – love, international relations, negotiations – can actually have their underlying mechanics modelled, and often accurately predicted, within a game-theoretic framework. Game theory is especially helpful to model situations in which individuals’ incentives are not atomic – that is, they interact with one another – which is quite often the case in the real world.

A fundamental building block of the field is a payoff matrix. A payoff matrix is where an individual’s decisions are mapped to “payoffs,” or return values, for an individual taking a certain decision in a moment in the game. For example, if you have $100 at the start of time, and choose to invest it at an interest rate of 10%, at the next time step in the game, you’ll have $110.

These can get a lot more complicated and lead to some really counterintuitive results. One is the prisoner’s dilemma, which can analogously be used to explain (but not justify) how nuclear war may collectively occur between rival nation-states even if individually none of them would prefer this outcome to other alternatives.

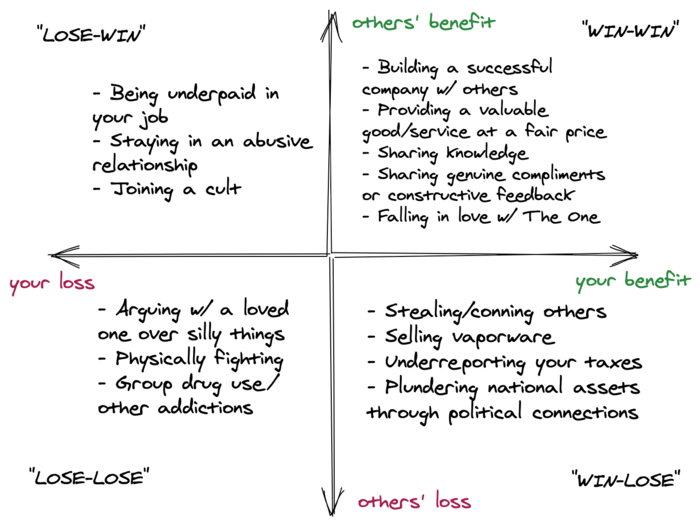

Here’s my attempt to partition certain life activities into different kinds of games. That is, the “win-win,” or mutually beneficial, are in the top right and the “lose-lose,” or mutually destructive, are in the bottom left:

Payoff values for life activities in (you, them)-space.

As I reflect back on them, I realize I spent a lot of my college years and early 20s playing “lose-lose,” “win-lose,” or “lose-win” games. As I get older, I’ve become very tired of these and want to play “win-win” games as much as possible.

Related to game theory, I discovered the concept of asymmetric opportunities from Naval Ravikant, the CEO of AngelList, a few years ago. These are opportunities for which there is a chance for a massive upside – building generational wealth, falling in love, shifting the future course of your life – but the maximum downside is small – a small cash expense, a lost evening, a minor ego hit.

Some examples of asymmetric opportunities, according to Ravikant, are: invest in startups, go on many first dates, create a book, podcast, or video, move to a big city, buy Bitcoin, and tweet. Importantly, asymmetric opportunities are nearly always win-win; that is, it is very difficult to get extraordinarily rich without solving an important problem for others at scale.1

Now that I have grown out of my tumultuous 20s into a stable, happy 30-something, I sometimes look back at some of the asymmetric opportunities that I missed in my early professional life. I write this post as a way to reflect on these, and by way of doing so, potentially share some of my learnings to others.

First, the asymmetric opportunities whose lost upside is pretty easy to quantify and collectively totals around $25 million:

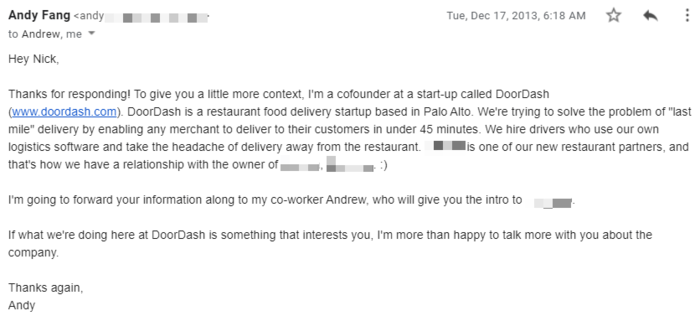

- I was in contact with Andy Fang, the CTO of DoorDash, in December 2013 when I was a master’s student at Stanford. I had recently discovered the site and it was obvious to me that their high-touch, branded delivery experience was the best user experience in the food ordering space.2

- I was so passionate about it I reached out to Andy through a mutual friend to help them make a demo website for the owner of one of my favorite downtown Palo Alto restaurants, who I knew was just onboarding with DoorDash:

- After I made the site for the restaurant owner, I showed up to his dilapidated apartment at 10pm to demo it.3 He really liked it. But then, he started asking for a lot more features that I didn’t have time to build, and started profusely smoking in the small, confined space. I got a bit weirded out about the whole thing, left, and never talked to Andy or the DoorDash folks again.

- At the time, DoorDash had just raised its seed round, so was probably valued at around $50 million. Today, it’s worth $28 billion. If I had worked for Andy for a few years – and I dunno, made more restaurant websites for him? 🤷 – for 0.05% of the company, I would now have $15 million for my efforts.

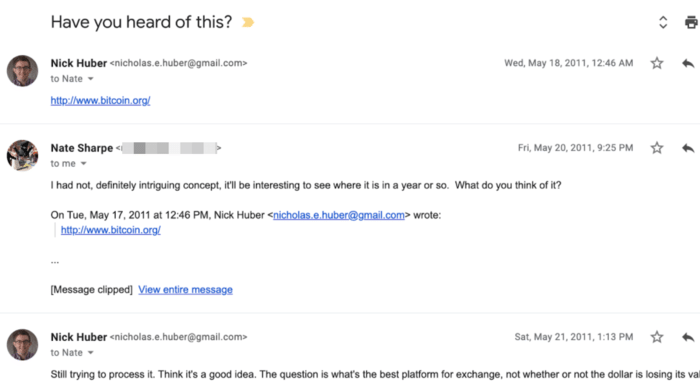

- In 2011, when I was in grad school in the UK, I emailed my friend Nate about Bitcoin and we discussed what an interesting idea it was, and its potential applications:

- If either one of us had invested just $1000 after this conversation in May 2011, it would now be worth $10 million. It didn’t even occur to me to spend 5 minutes researching the technology or figuring out how to purchase some in case it caught on.4

Now, the slightly harder to quantify but still large, missed opportunities that, between friends, let’s say add up to roughly another $15 million:

- When I was an eager-beaver, over-confident undergrad at Harvard Mark Zuckerberg would often come to campus to recruit students to work for him during my freshman year. I remember he always wore these unfashionable chunky black rubber sandals and a preppy North Face vest that never quite seemed to match his overall look. What I do not remember is thinking, for even 5 short minutes, about the interesting social dynamics and connections www.thefacebook.com was enabling, and how that might present me with a worthwhile opportunity.

- During grad school, I would often read and drink coffee late at night at Philz Coffee in Downtown Palo Alto, where I would have animated conversations with Juan Benet about knowledge graphs and neural networks. Later, Juan would start Protocol Labs, which developed Filecoin and IPFS, cryptocurrency technologies for distributed file storage. I’m still a little hazy on the details of how it works, but as of this writing, Filecoin’s total value, or its market capitalization, is $4.8 billion. Collaborating on something with him didn’t ever seriously cross my mind.

- When I was an advertising manager at The Crimson in 2006-2008, I directly worked with two guys who were always checking the price of Apple stock on Google Finance with one passionately imploring the other it was still very undervalued. They later, with a third guy, started what appears to be a really fantastic company that is something like an App Store for education, in which students can install and log into different educational apps with a single, central identity. Their company valuation isn’t public but it’s probably worth between $100 and $500 million currently. I spent all of my time at the newspaper focused on hitting my sales quota,5 and no time dreaming up any plans with them.

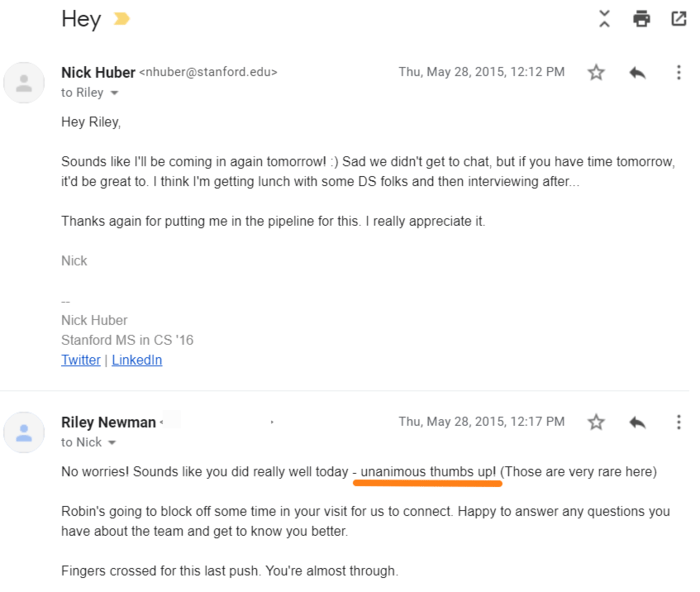

- In late 2013, I spent 6-10 hours/day teaching myself to program at a Hacker Dojo in Mountain View. I finally plucked up the courage to reach out to the Head of Data Science at Airbnb, impressed him, and made it to a final round interview with his team. Instead of brushing up on intermediate SQL, I spent a lot of time worrying about what to wear.

- I failed the final round interview on a few difficult questions about window functions and didn’t get the job. I am proud to say that I did turn this story on its head by getting the job 1.5 years later, but of course at a higher Airbnb valuation:6

- Through interning at Facebook in college and later working at Airbnb, I was able to work nearby some data engineering legends. The creator of GraphQL and Dagster was on my summer basketball team and the creator of Airflow and Superset was on my same floor. When I was at Airbnb, I quickly fell in love with Superset’s quick interactive, slice-and-dice features and promise of analytics at the speed of thought. My Superset dashboards had more views than any other data scientist in our 50-person team. Now, both are CEOs at high-potential SaaS startups, borne out of their learnings scaling analytics tasks at these tech giants. I didn’t even once talk to either of these guys for even a 15-minute coffee, or ponder how these technologies could be applied at other companies.

As I reflect back on my college years and early 20s, I can pull out a few key, thematic blind spots in my mindset and behavior that led me to missing out on such quantifiable and unquantifiable opportunities:

- I didn’t have any life foundation. I didn’t have any meaningfully deep relationships or commitments in my personal life. I used to have a libertarian view that such entanglements constricted my freedom and therefore should be avoided. Now, I hold a communitarian point of view, namely it’s impossible for me to know right from wrong, or even formulate basic objectives, without these bonds. My wife, my daughter, my closer relationship with my parents, and my many meaningful work associations give my life the higher sense of duty, purpose, and mission that it previously lacked.

- I didn’t have any explicit goals. My overall life mission prior to ~2015 is 99% captured as “be excellent, get rich.” While this may have helped me in my academic career and establish certain core habits, it was an insufficient life mission. That is, why “be excellent & get rich?” How do you measure it? Obtain it? And for what? What is all the effort for?

- I was often worried about appearances. In college, I was worried about what others were thinking of me, not what interested me. In grad school or my first few jobs, I worried much more about appearing competent than about learning and contributing.

- I was afraid to try new things. I had a fixed mindset and saw new opportunities as threats that I wouldn’t be able to achieve with my current skills, instead of seeing them as opportunities to grow. I overvalued knowledge and perfection and undervalued application. I found safety in the implicit beliefs of those around me rather than having the bravery to form my own.

- I was often only thinking about myself. I was focused almost exclusively on my side of the ‘payoff matrix’ not about the others I was ‘playing with.’ Ironically, I had a large sense of self-importance, but very little true confidence.

- I was focused on the short-term. In school, I spent a lot of time planning my course schedule, but never left time to deeply consider what I wanted to do with the skills and knowledge they contained. I was afraid to make an ambitious, far-reaching goal and not hit it. I frequently focused on insignificant things that could be measured (grades, employer prestige, school prestige, cash salary, appearance, books read), over things that mattered (relationships, love, connection, family, health, wisdom, perspective).

- I didn’t know how to package and sell my skills. I didn’t really know what my unique skills were, nor how to package them. In the years that followed, I would develop a niche and professional reputation in a specific area, which would allow for opportunities to come to me, instead of constantly having to seek them out.

The beautiful thing about having missed out on so much is that means there is much to learn. Failure is always the best teacher, because there is often no compression algorithm for experience. I learned more about sales, management, love, planning, and analytics by failing horribly than I ever did knocking it out of the park on an easy task.

To hammer the point home, one fun counterfactual I enjoy reminding myself about is on time travel. Everyone agrees that if you went back in time, say 15 years to your high school days, to change something, it would have huge ramifications for your future, or potentially the future of the entire planet. However, very few of these same people will admit that they – right now, in this present moment – have the ability to dramatically alter the course of their future life and the future of the world.

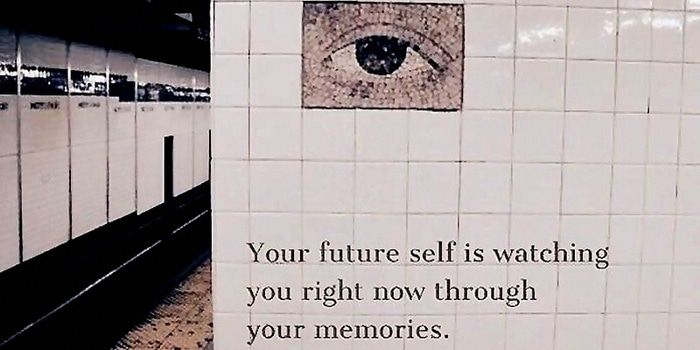

Perhaps even more succinctly said:

Or relatedly, what Jeff Bezos would often say when a financial analyst congratulates him on a “good quarter” in 2018:

Those quarterly results were fully baked three years ago. Today I’m working on a quarter that will happen in 2020, not next quarter. Next quarter is done already and it’s probably been done for a couple years…If we have a good quarter it’s because of work we did 3, 4, 5 years ago. It’s not because we did a good job this quarter.

Previously, I would often unproductively and incessantly ruminate about past mistakes. However, my past losses and missed opportunities no longer cripple me. Reflecting on and sharing them gives me a language to explain them (to others and to myself), is an intrinsically rewarding task, and commits and propels me to further change.

It’s difficult to exhaustively map out all of the changes I have made – or am still in the progress of making – that have helped drive the outcomes I want. But in some rough order, these are the things that have helped:

- I have a strong life foundation – my nuclear family, my larger family, my friends and associates – as mentioned before. This community is my reason for achieving, a group to share the spoils and challenges with, and to laugh with and love, regardless of any immediate outcome, positive or negative. They are my one True North.

- I’ve chosen a field to go deep in – analytics/data science, for at least the past 7 years. I’ve developed an expertise and specific knowledge in it, and I am trying to share and grow my knowledge in it more and whenever I can. As the field continues to grow, the value of my knowledge and experience somehow seems to compound.

- I have a running Google Doc on a rough set of goals for myself, in objective and key result format, on what I would like to accomplish in the next 12-18 months. I also have listed down some bigger, more formless goals for 5-10 years in the future.7 Goals are specifically important for a few reasons:

- They help you make tradeoffs that bring into reality your overall objectives. To give a simple example, one of my priorities is to be comfortable (of course) but I also want to save money for future ventures. It might sound silly but now that I have enumerated the latter and attached specific importance to it, I literally think about this nearly every time I forget to turn off an air conditioner around the house, and the opportunity cost of having done so.

- They justify why you need to push through even when it gets tough. If you haven’t explicitly stated what your goal is, it’s incredibly tempting to not see it to completion, either by lowering the bar to make it easier to achieve or just forgetting it entirely.

- They give you an objective progress metric to track progress to. One of my 2021 goals was to lose weight, specifically to be down to 100kg by April 1 (achieved on March 15) and 90kg by end December (in progress). By weighing in every week and recording my progress on a simple spreadsheet I am both reminding myself of this goals’ importance through ritual and providing myself with an objective measure of progress for those times if I ever get down about my progress.

- The exercise of sitting with yourself and explicitly stating and ranking your goals helps you find your true voice, instead of using others’ value systems to be your definition of success.

- I have tried to adopt a growth mindset to replace my previously fixed one. I have listed out and am working on several experiments that will help me with my growth.8 I am more comfortable sharing intermediate progress towards my end goals rather than feeling I need to wait until the end. I am OK to be challenged and try new things.

- I try to carve out specific time for dedicated learning and reflection. I am constantly reading to keep up with the latest trends in my industry and to mentally unwind my brain at night.

- I listen more and talk less. I already know what I think on a subject (writing helps immensely here), what’s more interesting to me is getting others’ points of view. I am confident enough in myself to ask about things I’m genuinely interested in and don’t always need to be the center of a conversation.

- I ask for specific help when needed. If I want to learn from someone else, instead of asking for “an hour to pick their brain,” I’ll ask them what they read to keep up with their area of expertise. If I watch an interview with a founder/business leader that I want advice from or an introduction to, I figure out a way on Twitter/LinkedIn to email them around a specific, clear ask. The response rate, even among senior business/technology leaders, is surprisingly high. Relatedly, instead of being intimidated by others’ success, I am inspired by it.

- I am comfortable to just be myself. First, once you love and accept yourself, you realize life is just too short to anything else. However, over time, you also start to realize that this is also the best strategic option. When you stop trying to be someone you’re not, you can escape competition through authenticity, because no one can compete with you on being you.

Entire industries are being reformed by technology and will continue to be in the next 5-10 years. I’m a diligent, rapid, commercially minded learner, with a little bit of dry powder and a growing tribe, ready to capture the next asymmetric opportunities that come my way. In 2031, I look forward to writing the follow up to this post on the results from further iterations on these newly established core principles.

If you have any thoughts on this, please don’t hesitate to reach out or drop me a note at nicholas.e.huber@gmail.com.

1 There are certain interesting historical anomalies worth discussing, but I believe they are the exceptions that prove the rule. For instance, colonialism was a massive, once-in-a-generation win-lose opportunity for European settlers and nation-states to the detriment of colonized peoples, but it’s hard to see many modern equivalents.

2 As a lazy grad student who couldn’t cook, I was an extremely well informed market participant/connoisseur in the food-delivery landscape. As I recall, in 2013, DoorDash was the only – of at that time many – food delivery platforms that committed to a 45-minute SLA and all meals came in a beautiful, branded DoorDash bag delivered by pleasant (salaried?) deliverypeople. Food from other apps was often late, incorrect and came horribly mangled.

3 I don’t remember why we met so late in the evening.

4 Fortunately, I did get a second opportunity in late 2017 after the BTC crash and went in with about 5% of my total assets at the time, which has returned to me ~10x already.

5 Which I always hit…but like…who cares now?

6 Making my stake comparatively worth less.

7 I actually may share these in a future post. Do let me know if it would be interesting. These are always a bit of a work in progress, but, at a high level, I have roughly three big thematic buckets of personal OKRs for 2021: (1) maintain & improve health, (2) learn & earn, and (3) grow & connect.

8 Potentially more on this in a future post. Let me know if you’re interested in it!